Mortgage rates have hit their lowest point in over a year and a half. And that’s big news if you’ve been sitting on the homebuying sidelines waiting for this moment.

Even a small decline in rates could help you get a better monthly payment than you would expect on your next home. And the drop that’s happened recently isn’t small. As Sam Khater, Chief Economist at Freddie Mac, says:

“Mortgage rates have fallen more than half a percent . . . and are at their lowest level since February 2023.”

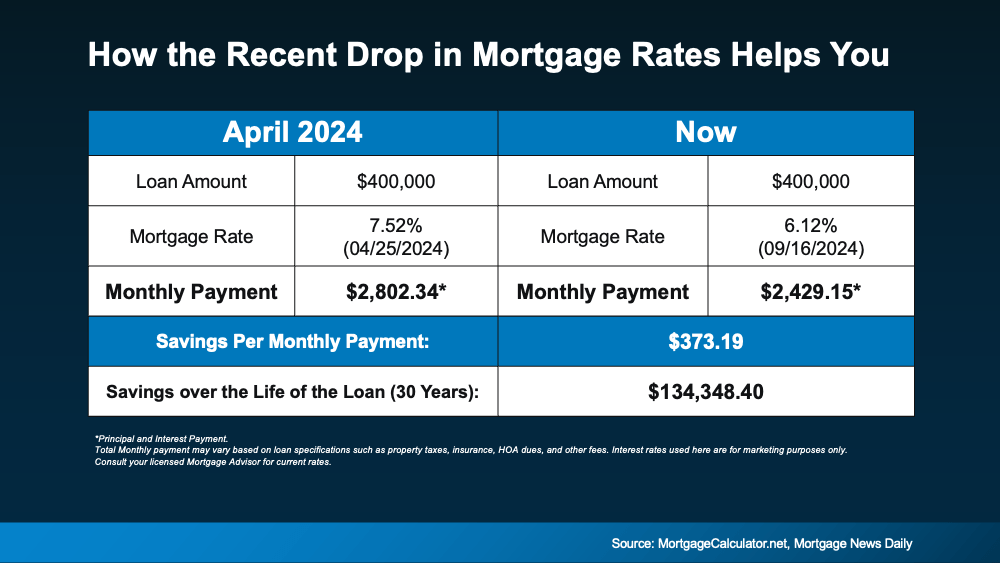

But if you want to see it to really believe it, here’s how the math shakes out. Take a closer look at the impact on your monthly payment.

The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house back in April (this year’s mortgage rate high), versus what it could look like if you buy a home now (see below):

Bottom Line

With the recent drop in mortgage rates, the purchasing power you have right now is better than it’s been in almost two years. Talk to a local real estate agent about your options and how you can make the most of this moment you’ve been waiting for.